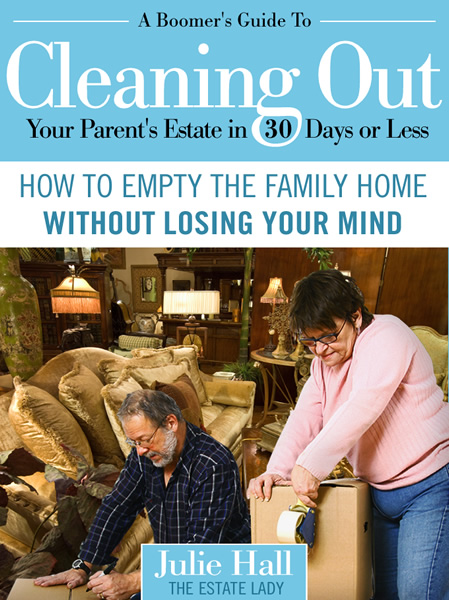

Over the next couple of weeks, I want to give you a taste of the practical wisdom I have poured into my latest book. The title is “A Boomer’s Guide to Cleaning Out Your Parents’ Estate in 30 Days or Less.” I definitely believe this is a realistic time frame, although many boomers spend years struggling with this process. Sometimes they move the parents’ belongings to expensive storage buildings, while they fight or avoid dealing with the stuff. It doesn’t have to be that painful or protracted; the estate can be cleared out in a deliberate and decisive way. It can be done with this guide.

This is a practical workbook that you can take along in your briefcase or pocketbook, and check off completed items, make personal notes, fill in worksheets.

Here’s a taste of what to expect, except in my book there is room for notes and there are boxes beside each item to check when complete.

WHAT TO DO IMMEDIATELY WHEN MOM OR DAD HAVE PASSED AND THE ESTATE REMAINS

The executor has a responsibility to protect all that the parents owned until all decisions have been made about the proper distribution and dissolution methods. The following are important, critical first steps to be taken by the executor or estate attorney in order to properly protect and prepare the estate on behalf of the deceased parents.

- Collect keys / change residential and other property locks (no exceptions)

- New master keys to be in the executor’s and/or estate attorney’s possession only

- Notify heirs and family members that locks have been changed for security reasons

- Remove valuables (should only be done by the executor or executrix) including: (see my book for the specifics)

- Notify heirs and family members that removal of valuables is temporary only until the estate is settled

- Prepare a list of all valuables to be kept in executor’s or estate attorney’s file for documentation

- Hire a professional appraiser to assess all valuables

This represents only a third of the material I’ve given in my book for this one list alone. If you’d like to read more, you can get a copy of my book by clicking on the link at the right of this blog. Another sample of my book next week!

© 2010 Julie Hall